Have you ever seen a company report millions in profit but struggle to pay its bills? This contradiction underscores a crucial difference in business finance: the gap between profit and actual cash.

The cash flow statement bridges this gap, showing how a company manages its most vital asset—cash. This guide will explain its components, importance, and how to analyse it for assessing financial health. Whether you’re an investor, business owner, or finance student, mastering this tool is essential.

What is a Cash Flow Statement?

A cash flow statement, also known as the statement of cash flows, is a financial report that details the movement of cash and cash equivalents (CC&E) into and out of a company over a specific accounting period.

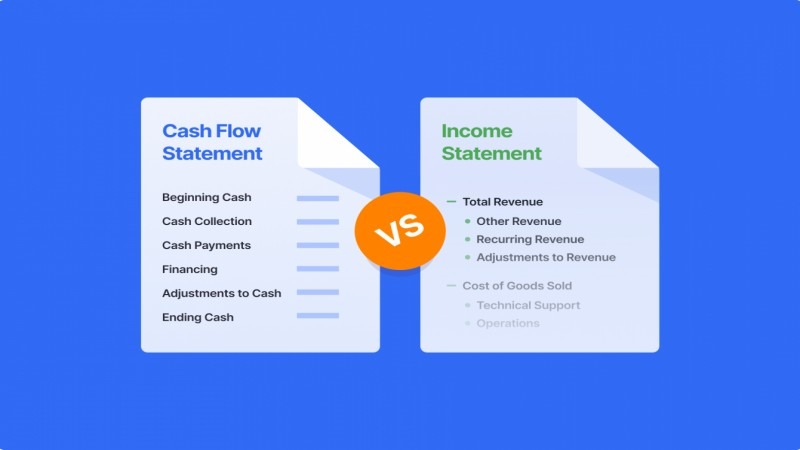

Unlike the income statement, which is based on accrual accounting and can include non-cash revenues and expenses (like depreciation), the cash flow statement focuses purely on cash transactions.

It essentially acts as a corporate chequebook, showing where the money came from and where it went. This makes it an indispensable tool for assessing a company’s liquidity, solvency, and overall financial viability.

The Core Purpose: Why the Cash Flow Statement is a Vital Tool

The cash flow statement offers insights that other financial reports can’t. Here’s why stakeholders rely on it:

- For Investors: It helps assess a company’s ability to generate cash, pay dividends, and fund growth without external financing.

- For Creditors & Lenders: It shows a company’s ability to service debt and repay loans.

- For Management: It’s key for budgeting, forecasting cash needs, and making strategic decisions.

- Verifying Earnings Quality: It checks the net income reported in the income statement, highlighting any discrepancies between profits and cash flow from operations.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

To fully appreciate the cash flow statement, it’s helpful to see how it fits with the other two primary financial statements. Each provides a unique perspective on a company’s financial standing.

| Financial Statement | What It Shows | Timeframe | Accounting Method |

| Cash Flow Statement | The movement of actual cash (inflows & outflows) from operations, investing, and financing. | Period of Time (e.g., Quarter, Year) | Cash Basis |

| Income Statement | The company’s profitability (Revenues minus Expenses) over a period. | Period of Time (e.g., Quarter, Year) | Accrual Basis |

| Balance Sheet | A snapshot of the company’s financial position (Assets = Liabilities + Equity). | Single Point in Time | Accrual Basis |

In essence, the Income Statement tells you if the company made a profit, the Balance Sheet tells you what it owns and owes, and the cash flow statement tells you where the cash to run the business actually came from and went.

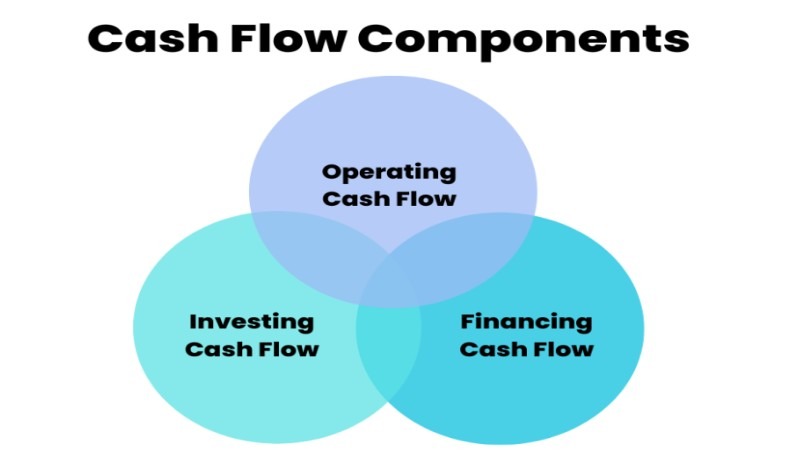

The 3 Core Components of a Cash Flow Statement

The cash flow statement is divided into three sections, helping analysts understand how a company generates and uses cash. A positive cash flow from financing (borrowing) while operations are losing cash can signal trouble.

1. Cash Flows from Operating Activities (CFO)

This section reflects the cash generated by a company’s core operations. A growing, positive CFO is key to a healthy business.

- Typical Inflows: Cash from customers, interest, and dividends.

- Typical Outflows: Payments to suppliers, employees, taxes, and debt interest.

The section starts with Net Income and adjusts for non-cash items like depreciation and changes in working capital (indirect method).

2. Cash Flows from Investing Activities (CFI)

This section reports the cash used for, or generated from, investments. It primarily includes the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E), as well as other investments like securities of other companies.

- Typical Inflows: Cash from the sale of PP&E, proceeds from the sale of debt or equity securities of other entities, collection of principal on loans made to other entities.

- Typical Outflows: Cash paid to purchase PP&E (also known as capital expenditures or CapEx), payments to purchase debt or equity securities, making loans to other entities.

For a healthy, growing company, CFI is often negative. This is not a bad sign; it indicates that the company is reinvesting in its future by purchasing new assets to expand its capacity and efficiency.

3. Cash Flows from Financing Activities (CFF)

This section details the flow of cash between a company and its owners (shareholders) and its creditors. It shows how a company raises capital and returns it to investors.

- Typical Inflows: Proceeds from issuing company shares (equity), proceeds from issuing bonds or taking out loans (debt).

- Typical Outflows: Cash used to repurchase company shares (share buybacks), payments of dividends to shareholders, repayment of debt principal.

The story told by this section depends on the company’s stage. A young, growing company might have positive CFF from issuing stock to fund its expansion. A mature, stable company might have negative CFF as it uses its cash to repay debt and reward shareholders with dividends and buybacks.

How to Analyse a Cash Flow Statement

Simply reading the numbers on a cash flow statement isn’t enough; the real value comes from interpreting them to understand the story they tell about the company’s financial health and strategic direction. Here are key analytical steps and metrics to focus on.

The Bottom Line: Net Change in Cash

The first step is to look at the very bottom of the statement: the net increase or decrease in cash for the period. This figure is the sum of the net cash flows from the three activities (CFO + CFI + CFF).

Does the company have more cash at the end of the period than it started with? More importantly, look at the trend over several periods (e.g., the last 3-5 years). Is the company’s cash position consistently improving or deteriorating?

The Most Important Metric: Free Cash Flow (FCF)

While not always explicitly listed on the statement, Free Cash Flow (FCF) is a crucial metric that analysts derive from it. It represents the cash a company generates after accounting for the capital expenditures necessary to maintain or expand its asset base.

Formula: Free Cash Flow (FCF) = Cash from Operations – Capital Expenditures

Capital Expenditures are found in the investing activities section (usually listed as ‘Purchase of property, plant, and equipment’). FCF is the ‘free’ cash available to the company to pursue opportunities that enhance shareholder value, such as paying dividends, reducing debt, or making acquisitions. A company with strong and consistently growing FCF is often a very attractive investment.

Red Flags to Watch Out For in a Cash Flow Statement

A savvy analysis of the cash flow statement can reveal warning signs that might not be obvious from the income statement alone:

- Consistently Negative Cash Flow from Operations: This is the most serious red flag. If a company’s core business cannot generate cash, it cannot survive long-term without constantly raising new debt or equity, which is unsustainable.

- High Net Income but Low or Negative CFO: This indicates poor earnings quality. It might be caused by aggressive revenue recognition or a sharp increase in accounts receivable (i.e., the company is making sales on credit but isn’t collecting the cash).

- Relying on Financing to Pay for Operations: If negative CFO is being covered by large positive cash flow from financing (i.e., heavy borrowing), the company is essentially using debt to fund its operational losses—a recipe for disaster.

- Generating Cash by Selling Long-Term Assets: A positive CFI from consistently selling off productive assets could be a sign of distress, indicating the company is liquidating its future to meet short-term cash needs.

Cash Flow Management in Trading

The principles of analysing a corporate cash flow statement also apply to personal finance and active trading. For a trader, managing trading capital is as crucial as it is for any large company.

Why Capital Management is Key for Traders

Effective capital management ensures a trader can withstand the inevitable drawdowns and market volatility without being forced to close positions at an inopportune time. A trader’s ‘personal’ cash flow statement might look like this:

- Operating Cash Flow: Net profit or loss from closed trading positions.

- Financing Cash Flow: Deposits into the trading account (inflow) and withdrawals for personal expenses (outflow).

A disciplined trader ensures their operating cash flow is positive over the long run and avoids making frequent financing outflows (withdrawals) that deplete their trading capital.

Using Trading Platforms: An Ultima Markets Example

When using a brokerage platform like Ultima Markets, which provides access to instruments like forex and CFDs via powerful platforms such as MetaTrader 5, your deposited funds represent your core operating cash. The success of your trading depends on managing this cash effectively.

It is essential for traders to constantly monitor their account equity—the cash balance plus or minus the profit/loss of open positions. Ensuring sufficient free margin (usable cash) is vital to avoid margin calls. The principles of a cash flow statement—tracking inflows (profits, deposits) and outflows (losses, withdrawals)—are directly applicable.

Reliable deposits & withdrawals and robust fund safety measures are critical features of a trustworthy broker, as confirmed by numerous Ultima Markets reviews. Applying cash flow discipline to your trading account is a fundamental step towards long-term success.

Conclusion

The cash flow statement is far more than a simple accounting report; it is a powerful diagnostic tool for assessing the true financial health and operational efficiency of a business. While the income statement can be influenced by accounting estimates and policies, the cash flow statement offers a clear, unfiltered view of cash movements.

By carefully analysing the three core components—operating, investing, and financing activities—you can uncover insights into a company’s liquidity, solvency, and long-term strategic direction.

Whether you are evaluating a stock, managing a business, or even disciplining your own trading activities, a thorough understanding of the cash flow statement is an indispensable skill for making informed and profitable financial decisions.

FAQ

Q: What are the 3 main parts of a cash flow statement?

The three main parts are:

1. Cash Flows from Operating Activities: Cash generated from the company’s primary business operations.

2. Cash Flows from Investing Activities: Cash used for or generated from the purchase and sale of long-term assets and other investments.

3. Cash Flows from Financing Activities: Cash exchanged between the company and its owners/creditors, such as issuing stock or repaying debt. Together, they provide a complete picture of how a company manages its cash.

Q: What is the main purpose of a cash flow statement?

Its main purpose is to provide a detailed report on the cash inflows and outflows of a company during a specific period. It helps users assess the company’s ability to generate cash, meet its obligations (like paying debt and employees), fund its operations, and make investments. It serves as a crucial check on the quality of earnings reported on the income statement.

Q: Is a negative cash flow a bad sign?

Not necessarily; it depends on which section is negative. A negative cash flow from operating activities is almost always a bad sign, as it means the core business is losing cash. However, a negative cash flow from investing activities is often a positive sign for a growing company, as it signifies investment in future growth (e.g., buying new machinery). Context is key to the analysis.

Q: What is an example of cash flow from operating activities?

A classic example of a cash inflow from operating activities is the cash a retail company receives from customers when they purchase goods. An example of a cash outflow is the payment the company makes to its suppliers for the inventory it sells, or the salaries it pays to its employees.

Q: Can a profitable company go bankrupt?

Yes, absolutely. This is a classic business scenario where the cash flow statement is vital. A company can be profitable on paper (according to its income statement) but run out of cash. This can happen if it isn’t collecting payments from its customers fast enough (high accounts receivable) or if it has to pay its suppliers before it gets paid. Profit is an accounting concept; cash is the reality needed to pay bills and stay in business.