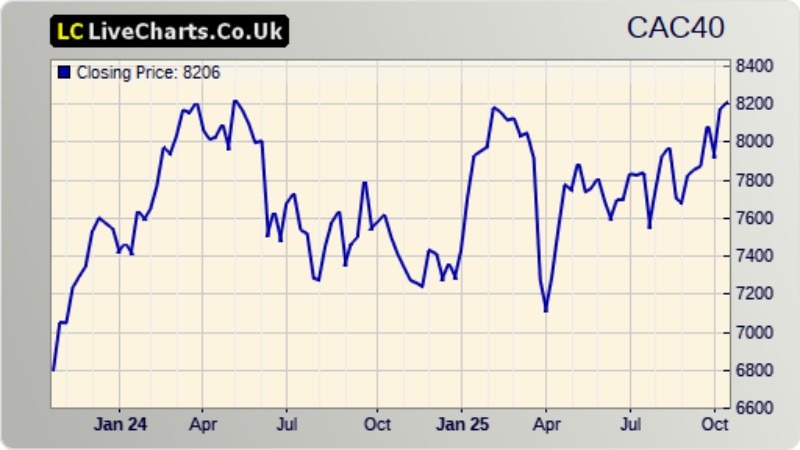

Looking to diversify your portfolio beyond US indices? The CAC 40 index offers a compelling gateway to the European economy, driven by factors distinct from the S&P 500 or NASDAQ. This comprehensive guide from a trader’s perspective will cover precisely what the CAC 40 is, analyze the crucial economic factors dictating its price, and detail actionable trading strategies.

What is the CAC 40 Index?

The CAC 40 is France’s premier stock market index, a capitalization-weighted measure of the 40 most significant and liquid companies on the Euronext Paris exchange. The name is an acronym for ‘Cotation Assistée en Continu’ (Continuous Assisted Quotation).

It serves as a primary barometer of the French economy and a key sentiment indicator for the wider European market. Its value is disseminated every 15 seconds during trading hours (09:00 to 17:30 CET).

Key Characteristics of the CAC 40

Understanding the core attributes of the CAC 40 is the first step towards trading it successfully. These characteristics define its behaviour and differentiate it from other global indices.

- Composition: The index is a curated collection of 40 ‘blue-chip’ stocks. They are selected by the independent ‘Conseil Scientifique’ based on substantial free-float market capitalization and high trading volumes.

- Calculation: It is a free-float market capitalization-weighted index. Each company’s influence is proportional to the market value of shares readily available for trading, meaning giants like LVMH have a much greater impact on the CAC 40’s daily movements.

- Economic Significance: The CAC 40 is a vital proxy for the overall performance of the French equity market. Its trajectory reflects investor confidence in French corporate profitability and the broader economic outlook for the Eurozone.

- Quarterly Review: The index composition is reviewed quarterly by the Conseil Scientifique. Companies are added or removed based on changes in market cap and liquidity, which can create trading opportunities around review dates.

What Companies Make Up the CAC 40?

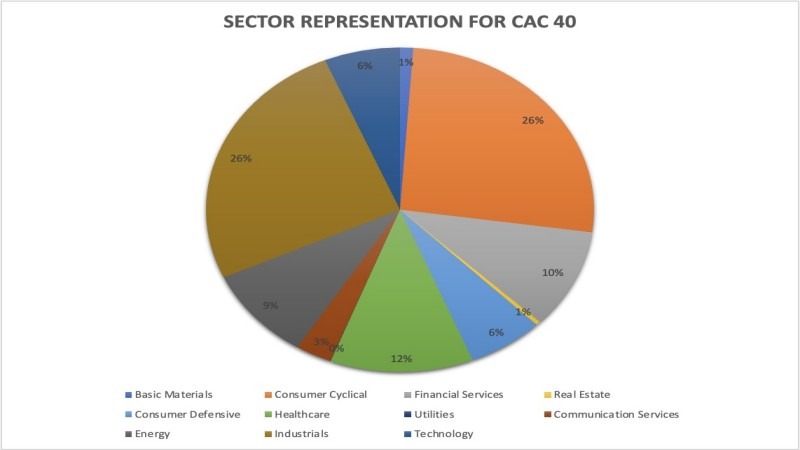

The CAC 40 index is uniquely weighted towards global luxury brands, industrial powerhouses, and major financial institutions. This sector concentration makes it distinct from indices like the NASDAQ 100 or the FTSE 100, and particularly sensitive to global consumer confidence and business investment cycles.

Top 10 CAC 40 Companies by Weight (Illustrative Data)

The table below illustrates the type of multinational corporations that dominate the index and their respective sectors. As a trader, it is vital to remember that a significant price move in one of the top-weighted stocks can single-handedly influence the direction of the entire CAC 40.

Note: Exact weightings change daily based on market price fluctuations.

| Company Name | Sector | Ticker Symbol | Approximate Weight |

| LVMH Moët Hennessy | Luxury Goods | MC.PA | ~13% |

| TotalEnergies SE | Integrated Oil & Gas | TTE.PA | ~7% |

| Sanofi | Pharmaceuticals | SAN.PA | ~6% |

| L’Oréal S.A. | Personal Care | OR.PA | ~5% |

| Schneider Electric | Industrial | SU.PA | ~5% |

| Airbus SE | Aerospace & Defense | AIR.PA | ~4% |

| Hermès International | Luxury Goods | RMS.PA | ~4% |

| AXA SA | Insurance | CS.PA | ~3% |

| BNP Paribas | Banking | BNP.PA | ~3% |

| Air Liquide | Chemicals | AI.PA | ~3% |

What are the Key Factors Influencing the CAC 40’s Price?

The price of the CAC 40 is primarily influenced by a complex interplay of domestic French economic data, broader Eurozone monetary policy, the specific performance of its heavyweight sectors, the value of the Euro, and global market sentiment. A successful trader must monitor all these elements to anticipate potential market moves.

Macroeconomic Data

The index is highly sensitive to key economic indicators from France and the wider Eurozone. Positive data typically boosts investor confidence; negative data can drive the price lower. Traders must pay close attention to:

- GDP Growth Rate: A rising Gross Domestic Product (GDP) signals economic expansion, leading to higher corporate profits and a bullish outlook for the index. Watch for both the French and the overall Eurozone GDP figures.

- Inflation Rate (CPI): The Consumer Price Index (CPI) measures inflation. Persistently high inflation can erode corporate profit margins and prompt the European Central Bank (ECB) to tighten monetary policy, potentially pressuring stock prices. Conversely, inflation falling towards the ECB’s 2% target is often seen as positive.

- Unemployment Figures: Lower unemployment suggests a robust economy and stronger consumer spending power. This is particularly important for the CAC 40 due to its heavy weighting in consumer-facing companies.

- Purchasing Managers’ Index (PMI): These are forward-looking indicators that survey business managers. A reading above 50 indicates expansion in the manufacturing or services sectors, which is generally bullish for the CAC 40.

European Central Bank (ECB) Monetary Policy

Decisions and rhetoric from the European Central Bank (ECB) directly impact the CAC 40. The ECB’s mandate is to maintain price stability, using tools to stimulate or cool the economy.

- Interest Rates: Rate hikes usually strengthen the Euro but raise company borrowing costs, potentially weighing on stock valuations. Conversely, rate cuts stimulate the economy and boost stock prices.

- Quantitative Easing (QE) and Tightening (QT): QE (central bank buying bonds) injects liquidity and supports indices like the CAC 40. Quantitative Tightening (QT) removes liquidity and acts as a headwind.

Sector-Specific Performance (Luxury & Industrials)

Due to its heavy concentration in luxury goods (LVMH, Hermès, Kering) and industrial sectors (Airbus, Schneider Electric, Safran), the CAC 40’s performance is uniquely dependent on their health. This is a critical point of differentiation.

For instance, data on consumer demand from China for luxury products can directly impact the index’s direction more than a German manufacturing report might. Traders should monitor luxury goods sales data, international travel statistics (affecting Airbus), and global industrial production figures.

Value of the Euro (EUR/USD)

A weaker Euro is a tailwind for the CAC 40. Many component companies are major global exporters earning revenue in other currencies (like the US Dollar). A weak Euro translates foreign earnings into more Euros, boosting reported profits. Conversely, a strengthening Euro acts as a headwind, making French exports more expensive and reducing overseas profit value.

How to Trade the CAC 40 Index?

Traders can gain exposure to the CAC 40’s price movements without buying individual shares, primarily through derivative products. The most common methods are Contracts for Difference (CFDs), ETFs, and futures contracts. For a reliable, secure trading environment, many choose to trade on a robust platform like Ultima Markets MT5, knowing that broker reputation and fund safety are paramount.

Trading the CAC 40 with CFDs

CFDs are the most popular method for retail traders due to their flexibility and accessibility. A CFD is a contract between a trader and a broker to exchange the difference in the value of an asset (in this case, the CAC 40) between the time the contract is opened and when it is closed. They allow you to speculate on the index’s price rising (going long) or falling (going short) without owning any underlying assets. Key benefits include:

- Leverage: This feature allows you to control a larger CAC 40 position with a smaller capital outlay (e.g., a $20,000 position with $1,000 margin at 20:1 leverage). Crucially, while leverage amplifies profits, it equally amplifies losses, demanding a robust risk management strategy.

- Liquidity: The CAC 40 is a highly traded index. Its CFD products have high volume, ensuring tight spreads (difference between buy/sell price) and efficient execution.

- Flexibility: CFDs make it easy to profit from a falling market (short-selling) or a rising one, a key advantage over holding stocks.

Trading the CAC 40 (France 40) with Ultima Markets

Brokerages like Ultima Markets provide seamless access to the CAC 40 via a CFD. On trading platforms, you will often find it listed under a ticker like “France 40” or “FRA40”. Ultima Markets offers this instrument, allowing traders to execute strategies based on real-time price movements. You can verify their standing by checking Ultima Markets Reviews, ensuring a direct and efficient way to apply analysis to live market conditions.

Proven Strategies for Trading the CAC 40

Effective strategies for trading the CAC 40 often blend technical and fundamental analysis. The most suitable strategy will depend on market conditions (trending or ranging) and your personal trading style. Common approaches include trend following, range trading, and news-based trading.

Strategy 1: Trend Following

This strategy involves identifying and trading in the direction of the dominant market trend (a market in motion tends to stay in motion). Traders define the long-term trend using 50-day and 200-day moving averages (MAs).

Entry signals include a long trade on a “golden cross” (50-day MA above 200-day MA) or shorting on a “death cross” (50-day MA below 200-day MA). The Relative Strength Index (RSI) refines entries: buy on pullbacks (RSI $\to$ 30) in uptrends, or sell on rallies (RSI $\to$ 70) in downtrends.

Strategy 2: Support and Resistance Trading

The CAC 40 often trades within identifiable price ranges. This strategy identifies historical support (price floor) and resistance (price ceiling) levels on daily/4-hour charts. The approach is simple: buy near support (stop-loss below) or sell near resistance (stop-loss above). Tools like Fibonacci retracement and pivot points refine turning points.

Strategy 3: News-Based Trading

This high-impact strategy trades on volatility created by major economic announcements. Monitor an economic calendar for events like ECB interest rate decisions, CPI inflation, or French GDP figures.

For example, lower-than-expected inflation may increase the chance of an ECB rate cut, which is typically bullish for the CAC 40, creating a long entry. This strategy demands discipline and speed, as markets react within seconds, and initial price spikes can be erratic. Pre-defined entry and exit points are crucial.

Conclusion

The CAC 40 is a dynamic reflection of French corporate strength, European economic sentiment, and global consumer trends. Success requires a deep understanding of its unique composition—especially the influence of the luxury and industrial sectors.

By diligently analysing key drivers from the ECB and the broader Eurozone, and using instruments like Contracts for Difference (CFDs), you can effectively navigate and capitalise on the distinct opportunities presented by the CAC 40. Your next step: analyze its current trend and determine the best trading strategy.

FAQ

Q:What is the best time to trade the CAC 40?

The optimal time to trade the CAC 40 is during its official trading hours (09:00 to 17:30 CET). The highest liquidity and volatility, which often create the best trading opportunities, are typically seen during the first hour of trading (09:00 – 10:00 CET) as the market reacts to overnight news, and when it overlaps with the US market open (15:30 – 17:30 CET).

Q:Is the CAC 40 a good investment?

As a long-term investment, the CAC 40 provides exposure to top-tier European companies with a global footprint. However, this article focuses on *trading* the index, which involves speculating on short-to-medium term price movements. For traders, its distinct trends and volatility can present numerous opportunities, but it is crucial to remember that trading CFDs on the index carries significant risk and may not be suitable for everyone.

Q:How does the CAC 40 compare to the DAX or FTSE 100?

Each European index has a unique sectoral fingerprint. The CAC 40 focuses on luxury and consumer goods. In contrast, the German DAX is dominated by industrial/automotive giants (sensitive to manufacturing data), and the UK’s FTSE 100 by financial, energy, and mining companies. Each index thus reacts differently to global trends and currency fluctuations.

Q:How is the CAC 40 index calculated?

The CAC 40 is a free-float market capitalization-weighted index. Each company is weighted based on the market value of its readily available shares (the free float). The index’s total value sums all 40 companies’ market capitalizations, divided by an adjusted divisor to ensure value comparability over time.

Q:Can I trade the individual companies within the CAC 40?

Yes. Most brokers that offer European equities, including those providing CFD trading like Ultima Markets, will allow you to trade shares or CFDs of individual CAC 40 constituents like LVMH, TotalEnergies, or Sanofi. Before trading, ensure you understand the Ultima Markets Deposits & Withdrawals process. This can be a viable strategy if you have a strong analytical view on a particular sector or company within the French economy, rather than the index as a whole.