Is your business profitable on paper but constantly struggling with a shortage of cash? You are not alone. This common paradox highlights a critical truth in business management: profit does not equal cash.

This guide will demystify cash flow analysis, providing a clear roadmap to understanding precisely where your money comes from and where it goes. By the end, you will be equipped to assess your company’s financial stability, make smarter strategic decisions, and steer your business towards sustainable growth.

What is Cash Flow Analysis and Why is it Crucial?

Defining Cash Flow Analysis

Cash flow analysis is the process of examining a company’s cash flow statement to gain insights into its liquidity and solvency. It scrutinises the movement of money into (inflows) and out of (outflows) a business over a specific period. Unlike an income statement, which includes non-cash items like depreciation, a cash flow statement focuses solely on actual cash transactions.

This provides a true picture of a company’s ability to meet its short-term obligations and fund its operations. Think of it this way: Profit is the score in a game, but cash is the fuel needed to keep playing. A business can report a high profit due to sales made on credit, yet face a severe cash crunch if customers do not pay on time.

A thorough cash flow analysis bridges this gap, offering a realistic view of financial health that profitability figures alone cannot provide. For those managing their finances on platforms like Ultima Markets MT5, understanding these fundamental principles is key to making informed decisions.

The Importance of a Healthy Cash Flow

Regularly conducting a cash flow analysis is not merely an accounting exercise; it is a vital strategic tool. It empowers business owners, managers, and investors to make proactive, data-driven decisions. The benefits are wide-ranging and fundamental to long-term success:

- Assessing Liquidity and Solvency: It directly answers the most critical question: Does the business have enough cash to pay its bills, payroll, and suppliers on time?

- Informing Strategic Decisions: Understanding cash movements helps determine the right time for expansion, hiring new staff, purchasing major assets, or launching marketing campaigns.

- Identifying Financial Problems Early: A declining cash flow can be an early warning sign of deeper issues, such as poor inventory management, inefficient collection processes, or an unsustainable cost structure.

- Securing Funding: Lenders and investors scrutinise cash flow statements to gauge a company’s ability to repay loans or generate returns. A strong, positive cash flow significantly improves the chances of securing capital.

- Planning for Future Growth: By forecasting future cash flows based on historical analysis, a business can plan for capital expenditures and manage its growth trajectory effectively.

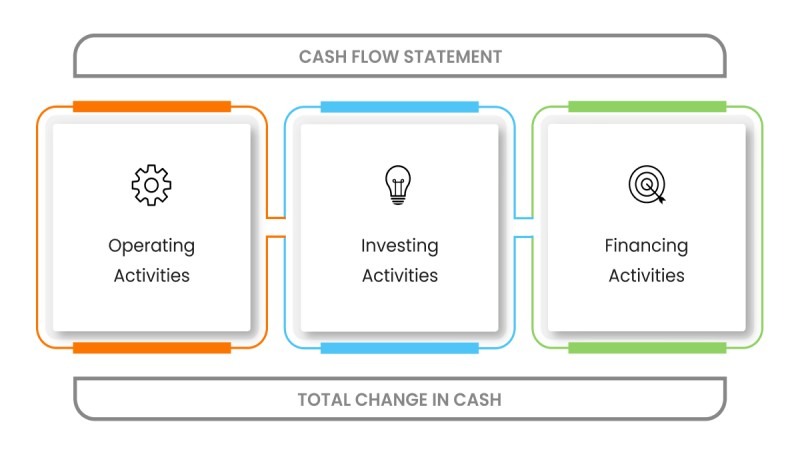

The 3 Core Components of a Cash Flow Statement

To perform an effective cash flow analysis, you must first understand its structure. A cash flow statement is universally divided into three distinct sections, each telling a different part of the company’s financial story.

1. Cash from Operating Activities (CFO)

This is arguably the most important section. It reflects the cash generated from a company’s principal, day-to-day business operations. A consistently positive cash flow from operations is a strong indicator of a healthy, sustainable core business. It shows that the company can generate sufficient cash internally to maintain and grow its operations without relying on external financing.

Examples include:

- Inflows: Cash received from the sale of goods or services, collections from customers (accounts receivable), interest and dividends received.

- Outflows: Cash paid to suppliers for inventory, payments for employee salaries and wages, tax payments, interest payments, and other operational expenses.

2. Cash from Investing Activities (CFI)

This section reports the cash used for, or generated from, a company’s investments. It provides insight into the company’s long-term growth strategy and capital expenditure. A negative CFI is often a positive sign for a growing company, as it indicates investment in assets for future expansion.

Conversely, a positive CFI could mean the company is selling off assets, which might be done to raise cash or to divest from unprofitable ventures.

Examples include:

- Inflows: Cash from the sale of property, plant, and equipment (PP&E), proceeds from the sale of debt or equity securities of other companies.

- Outflows: Purchase of PP&E, acquisition of other businesses, purchase of investment securities.

3. Cash from Financing Activities (CFF)

This section includes cash transactions between the company, its owners, and its creditors. It shows how the company raises capital and pays it back. Analysing CFF helps to understand the company’s financial structure, debt management, and shareholder return policies. The security of these transactions is paramount, which is why understanding measures related to fund safety is critical for investors.

Examples include:

- Inflows: Proceeds from issuing new shares of stock, cash from taking out bank loans or issuing bonds.

- Outflows: Repurchasing the company’s own stock (share buybacks), repayment of debt principal, payment of dividends to shareholders.

Summary Table of Cash Flow Components

| Category | Common Cash Inflows (+) | Common Cash Outflows (-) |

| Operating | Cash from customers, Interest received | Payments to suppliers, Employee salaries, Taxes |

| Investing | Sale of assets, Sale of securities | Purchase of assets, Purchase of securities |

| Financing | Issuing stock, Taking on debt | Repurchasing stock, Repaying debt, Paying dividends |

How to Perform a Cash Flow Analysis in 5 Simple Steps

Conducting a cash flow analysis is a systematic process. By following these steps, you can break down the complexity and derive meaningful conclusions about a company’s financial performance.

Step 1: Select a Reporting Period

The first step is to define the timeframe for your analysis. Businesses typically prepare cash flow statements monthly, quarterly, and annually. For internal management, a monthly analysis is often most useful for monitoring short-term liquidity.

For external stakeholders and trend analysis, quarterly and annual statements are standard. Consistency is key; comparing performance across identical periods (e.g., Q1 this year vs. Q1 last year) provides the most valuable insights.

Step 2: Calculate Cash Flow from Operating Activities

There are two methods for calculating CFO, although the result is the same:

- Indirect Method (Most Common): This method starts with the net income from the income statement and makes adjustments to convert it from an accrual basis to a cash basis. You add back non-cash expenses (like depreciation and amortisation) and adjust for changes in working capital accounts (like accounts receivable, inventory, and accounts payable).

- Direct Method: This method lists all major cash receipts and cash payments from operations directly. For example, it would show ‘Cash collected from customers’ minus ‘Cash paid to suppliers’. While more intuitive, it is less common because it requires more detailed data.

For most analyses, you will be working with statements prepared using the indirect method.

Step 3: Calculate Cash Flow from Investing Activities

This calculation is more straightforward. You simply sum up all cash inflows and outflows related to the purchase and sale of long-term assets and other investments. A positive figure means more cash was generated from selling assets than was spent on buying them, and vice versa for a negative figure.

Step 4: Calculate Cash Flow from Financing Activities

Similarly, you sum up all cash transactions with owners and lenders. This includes proceeds from issuing debt or equity, minus repayments of debt, dividend payments, and share buybacks. Understanding the flow of capital, including the ease of deposits and withdrawals, is fundamental in this section.

Step 5: Consolidate and Interpret the Net Cash Flow

Finally, sum the net cash flow from all three sections (CFO + CFI + CFF) to find the total net increase or decrease in cash for the period. This figure should match the change in the cash balance on the company’s balance sheet from the beginning to the end of the period.

Interpretation is key. A healthy, mature company typically shows: Positive CFO, Negative CFI (reinvesting in growth), and Negative CFF (paying down debt or returning money to shareholders).

Key Financial Ratios for a Deeper Cash Flow Analysis

To take your cash flow analysis to the next level, use financial ratios. These provide standardised metrics that can be used to compare a company’s performance over time or against its industry peers. Checking reviews and industry reports can provide valuable benchmarks.

Free Cash Flow (FCF)

This is one of the most significant metrics for investors. It represents the cash a company generates after accounting for the capital expenditures needed to maintain or expand its asset base.

Formula: FCF = Operating Cash Flow (CFO) – Capital Expenditures

A high FCF indicates strong financial flexibility, allowing a company to pursue opportunities like acquisitions, paying dividends, or reducing debt without needing external capital.

Operating Cash Flow Margin

This ratio measures how efficiently a company converts its sales revenue into cash from operations.

Formula: Operating Cash Flow Margin = (Operating Cash Flow / Total Revenue) * 100%

A higher margin is better, as it shows a greater ability to generate cash from its core business activities. A consistently increasing margin is a very positive sign.

Cash Flow Coverage Ratio

This is a solvency ratio that measures a company’s ability to service its total debt with the cash generated from operations. It is of particular interest to lenders.

Formula: Cash Flow Coverage Ratio = Operating Cash Flow / Total Debt

A ratio greater than 1.0 suggests the company generates enough cash to cover its debt obligations. A ratio below 1.0 could signal potential liquidity problems.

Conclusion

In conclusion, cash flow analysis is an indispensable tool for understanding the true financial pulse of a business, offering a clarity that profitability figures alone cannot provide. By methodically examining the three core components—Operating, Investing, and Financing activities—you gain a comprehensive picture of a company’s liquidity, solvency, and long-term viability.

Mastering this analysis allows you to identify strengths, diagnose potential weaknesses, and make strategic decisions with confidence. Do not wait for a cash crisis to emerge. Start implementing regular cash flow analysis today with a trusted platform like Ultima Markets to steer your business towards sustainable growth and lasting financial success.

FAQ

Q: What are the two main methods of cash flow analysis?

The two main methods are the Indirect Method and the Direct Method. The Indirect Method, which is far more common, starts with net income and adjusts for non-cash items and changes in working capital. The Direct Method directly lists all cash receipts and payments from operating activities, providing a clearer picture of cash movements but requiring more detailed data.

Q: What is considered a good cash flow?

“Good” is relative to the company’s industry, size, and stage of development. However, a universally strong sign is a consistently positive cash flow from operating activities (CFO). This indicates the core business is healthy and generating enough cash to sustain itself. For growth companies, a negative cash flow from investing (CFI) is also often seen as positive, as it signals reinvestment into the business’s future.

Q: Can a company have positive cash flow but still be unprofitable?

Yes, this is possible. A company can show a net positive cash flow for a period by undertaking significant financing or investing activities, even if its core operations are losing money. For example, taking out a large loan (a positive cash inflow from financing) or selling off a major asset (a positive inflow from investing) can mask a negative operating cash flow.

Q: How can a business improve its cash flow?

Businesses can improve cash flow through various strategies, including:

- Speeding up the collection of accounts receivable (invoicing promptly, offering discounts for early payment).

- Improving inventory management to reduce holding costs and avoid overstocking.

- Negotiating longer payment terms with suppliers (extending accounts payable).

- Leasing equipment instead of purchasing it outright to reduce large cash outflows.

- Controlling overhead expenses and cutting non-essential costs.