Navigating the world of Contracts for Difference (CFD) trading can seem complex, but understanding its core mechanics is crucial for success. Two of the most fundamental concepts you will encounter are CFD leverage and margin requirements. These powerful tools can significantly amplify your trading power, but they also carry inherent risks. This guide will provide a clear explanation of leverage and margin, demonstrate how to calculate your own margin requirements, and offer practical strategies for managing the risks involved. Grasping these concepts is the first step towards building a robust trading plan.

Recommended Reading For You

CFD Leverage and Margin Requirements: What Are Leverage and Margin in CFD Trading?

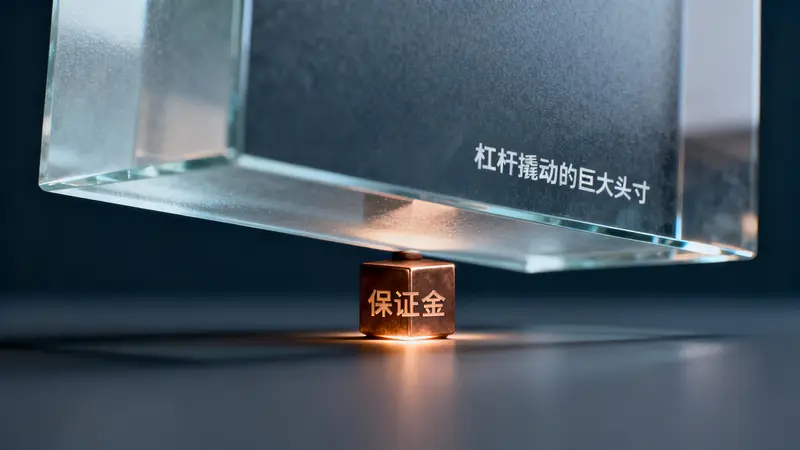

Leverage and margin are two sides of the same coin. They work in tandem to allow you to control a large position in the market with a relatively small amount of capital. However, it’s essential to understand their distinct roles.

Defining Leverage: Amplifying Your Trading Exposure

Think of leverage as a loan provided by your broker. It allows you to open a trading position that is worth much more than the capital in your account. Leverage is expressed as a ratio, such as 1:10, 1:20, or 1:30. A 1:10 leverage ratio means that for every £1 in your account, you can control a position worth £10.

For example, if you wanted to buy 100 shares of a company trading at £50 per share, the total value of the position would be £5,000. Without leverage, you would need to put up the full £5,000. However, with 1:10 leverage, you would only need to provide 1/10th of the position’s value, which is £500.

Defining Margin: The Required Deposit to Open a Position

Margin is the actual amount of money you need to deposit to open and maintain a leveraged trade. It is not a transaction fee but rather a portion of your account equity set aside as a good-faith deposit. This deposit, or ‘margin’, acts as collateral to cover any potential losses you might incur from the trade.

Using the previous example, the £500 required to open the £5,000 position is your margin. This amount is held by the broker for the duration of the trade.

The Inverse Relationship: How Leverage Affects Your Margin Requirement

There’s a simple, inverse relationship between leverage and margin:

- Higher Leverage = Lower Margin Requirement

- Lower Leverage = Higher Margin Requirement

If your broker offered 1:20 leverage instead of 1:10, your margin requirement for the same £5,000 trade would be halved to just £250. While this might seem attractive as it frees up more of your capital, it also significantly increases your risk, as both potential profits and potential losses are calculated on the full £5,000 position size.

CFD Leverage and Margin Requirements: How to Calculate CFD Margin Requirements

Being able to calculate margin is a non-negotiable skill for any CFD trader. It helps you understand the capital required for a trade and manage your risk effectively. Brokers like Ultima Markets often provide trading platforms like MT5 that calculate this for you, but understanding the formula is key.

The Margin Calculation Formula You Need to Know

The formula to calculate the required margin is straightforward:

Margin = (Total Position Value) / Leverage Ratio

Where the Total Position Value is the number of units (e.g., shares, contracts) multiplied by the current price of the asset.

Step-by-Step Example: Calculating Margin for an Equity CFD

Let’s walk through a practical example:

- Asset: Shares of Company ABC

- Current Share Price: £25

- Trade Size: You want to open a position equivalent to 200 shares.

- Leverage Ratio: Your broker offers 1:10 leverage.

Step 1: Calculate the Total Position Value.

200 shares * £25/share = £5,000

Step 2: Apply the Margin Formula.

Margin = £5,000 / 10 = £500

In this scenario, you would need £500 of available capital in your account to open this £5,000 position.

Understanding Margin Level, Used Margin, and Free Margin

Your trading platform will display several key margin-related metrics:

| Metric | Definition |

|---|---|

| Used Margin | The total amount of margin currently being used to keep all your open positions active. In our example, this is £500. |

| Free Margin | The amount of money in your account available to open new positions. It is your account equity minus the used margin. |

| Margin Level | This is a crucial health indicator for your account, expressed as a percentage. It is calculated as: (Equity / Used Margin) x 100%. A high margin level is good; a low margin level is a warning sign. |

CFD Leverage and Margin Requirements: Pros and Cons of CFD Trading with Leverage

Leverage is a double-edged sword. It can magnify your gains but can equally magnify your losses. Understanding this duality is paramount.

The Pros: Enhanced Capital Efficiency and Magnified Profits

- Capital Efficiency: You can control a significant market position with a small initial outlay, freeing up your capital for other trades or investments.

- Magnified Profits: Because your profits are based on the total position size, even a small positive price movement can result in a substantial return on your initial margin. For instance, a 5% increase on a £5,000 leveraged position yields a £250 profit, which is a 50% return on your £500 margin.

The Cons: Amplified Risk of Loss and Rapid Account Depletion

- Amplified Losses: The most significant drawback. Losses are also calculated on the total position size. A 5% price movement against your £5,000 position would result in a £250 loss, wiping out 50% of your initial margin.

- Risk of Margin Calls: If your losses accumulate, your margin level will drop. If it falls below a specific threshold, your broker will issue a margin call. It’s crucial to understand your broker’s policy on this and the importance of fund safety.

What is a Margin Call and How Can You Avoid It?

A margin call occurs when your account equity falls below the margin requirement for your open positions. Essentially, you no longer have enough funds to cover potential losses. When this happens, your broker will do one of two things:

- Request more funds: They will ask you to deposit more money into your account to bring your margin level back up to an acceptable percentage.

- Force-liquidate positions: If you fail to deposit funds, the broker will automatically start closing your open positions (usually the least profitable ones first) to reduce your used margin and prevent further losses.

Strategies to Avoid Margin Calls:

- Use Stop-Loss Orders: A stop-loss automatically closes a trade if the price moves against you by a pre-determined amount, capping your potential loss.

- Trade with Appropriate Leverage: Avoid using the maximum leverage available. Beginners, in particular, should start with very low leverage ratios.

- Monitor Your Margin Level: Keep a close eye on your margin level percentage. Don’t let it fall to dangerous levels (e.g., below 200%).

- Manage Position Sizing: Don’t risk too much of your capital on a single trade. A common rule is to risk no more than 1-2% of your account balance per trade.

Deepen Your Knowledge

To learn more about risk management and effective trading techniques, explore our guide on CFD Trading Tips and Strategies.

CFD Leverage and Margin Requirements: Conclusion

Leverage and margin are integral to CFD trading, offering the potential for enhanced returns and greater market access. However, this power comes with significant responsibility. A thorough understanding of how to calculate margin requirements and the immense risk of amplified losses is not just recommended—it’s essential for survival and success in the markets. By treating leverage with respect, implementing strict risk management rules, and continuously monitoring your account’s health, you can harness its benefits while mitigating its considerable dangers.

CFD Leverage and Margin Requirements: FAQ

1. What is a good leverage ratio for a beginner CFD trader?

For beginners, it is highly advisable to start with the lowest possible leverage ratio, such as 1:5 or 1:10. This limits your exposure to risk while you are still learning the dynamics of the market and developing your trading strategy. High leverage can quickly deplete an inexperienced trader’s account.

2. Can you lose more than your initial deposit with CFDs?

This depends on the broker and regulatory environment. In many jurisdictions, including the UK and EU, regulated brokers are required to provide Negative Balance Protection. This ensures that you cannot lose more than the total funds in your trading account. However, it’s crucial to confirm this with your broker before trading.

3. How do brokers set their margin requirements?

Brokers set margin requirements based on several factors, including regulatory limits (e.g., ESMA in Europe caps leverage for retail clients), the volatility of the underlying asset (more volatile assets often have higher margin requirements), and the liquidity of the market. They set these levels to protect both the trader and themselves from excessive risk.

4. What is the difference between initial margin and maintenance margin?

Initial margin is the amount required to open a position (the calculation we covered). Maintenance margin is the minimum amount of equity that must be maintained in the account to keep the position open. If your account equity drops below the maintenance margin level, it will trigger a margin call.

*This article is for informational purposes only and does not constitute financial advice. The content reflects the author’s personal opinions. CFD trading involves significant risk and may not be suitable for all investors. You could lose all of your invested capital.