Copper Market Poised for Further Gains Amid Structural Supply Deficit

Copper prices have surged to approximately $5.19 per pound in late November 2025, driven by persistent supply disruptions and strong demand expectations that position the metal for potential gains in the coming month. Currently testing four-month highs near $5.20, copper reflects a bullish outlook amid mine closures at major production sites like Indonesia’s Grasberg and ongoing labor challenges in Chile and Peru.

Fundamental Drivers

Fundamentally, the copper market is grappling with acute supply disruptions that have deepened a structural deficit. The most significant development has been the shutdown of Indonesia’s Grasberg mine, the world’s second-largest copper operation, following a fatal mudslide. The closure is expected to remove approximately 591,000 metric tons from the market through December 2026, triggering force majeure declarations and sharply reducing production guidance. Similarly, Chile’s Quebrada Blanca mine has encountered operational challenges that led to downgraded output forecasts. Global refined copper production growth has been revised downward to just 1.2% for 2025 and 2.2% for 2026, constrained by declining ore grades and permitting delays. These disruptions have reversed earlier surplus projections: the market now anticipates a 150,000-ton shortage in 2026, a significant shift from the previously estimated 209,000-ton surplus.

Notably, Cochilco, Chile’s state copper commission, has issued record-high price forecasts of $4.45 per pound for 2025 and $4.55 per pound for 2026, up from earlier projections of $4.30 for both years. The bullish outlook, the most optimistic in the commission’s history, extends through 2030 on expectations that supply will remain unable to match growing demand.

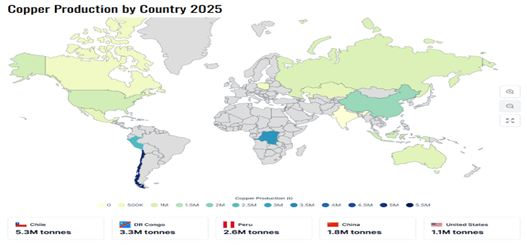

Source: World Population Review

Technical Analysis

From a technical perspective, copper exhibits bullish signals heading into December. Renko charts show a clean upward progression following extended consolidation, with prices rebounding from a $4.50 base in September to the current $5.10-$5.18 range. Momentum indicators reinforce this outlook: the stochastic oscillator displays constructive rebounds, while the MACD histogram has turned positive, signalling an early-stage uptrend. Key resistance sits at $5.18-$5.20 per pound, where a breakout could propel prices toward $5.50, assuming macroeconomic stability. Meanwhile, support at $4.95-$5.00 has been held firm, indicating investor accumulation during shallow pullbacks. This technical setup aligns with broader industrial metal strength heading into 2026 and could be amplified by Federal Reserve rate cuts and improving manufacturing data.

Summary

In summary, copper is poised for continued upward momentum through December 2025, fueled by ongoing supply-demand imbalances. However, risks from potential economic slowdowns or policy shifts require careful monitoring. While the 2026 outlook remains favorable, investors should track inventory levels and geopolitical developments closely. With year-to-date gains of 31.59% highlighting the rally’s robustness, Chinese economic indicators and U.S. policy decisions will be key drivers of near-term price volatility.