Are you seeking a more precise method to gauge a company’s operational performance, free from the distortions of accounting and financing decisions? While many traders default to net income or EBITDA, you may be overlooking a powerful metric that offers a clearer view of core profitability.

This comprehensive guide will deconstruct EBITA (Earnings Before Interest, Taxes, and Amortization), explaining precisely what it is, how to use it, and why it can be a pivotal tool in your trading and investment analysis.

What is EBITA (Earnings Before Interest, Taxes, and Amortization)?

EBITA is a financial performance indicator that measures a company’s operating profitability before the deduction of interest, taxes, and the amortization of intangible assets. It essentially reveals the profit a company generates from its core business activities, providing an unclouded perspective on performance by stripping out non-operating expenses and specific non-cash charges.

This focus on operational earnings makes EBITA an invaluable metric for understanding a business’s fundamental health. For instance, if a tech firm reports an operating income of $5,000,000 and has an amortization expense of $500,000 related to a past software acquisition, its EBITA would be $5,500,000, reflecting the profitability before this non-cash accounting charge.

The Core Formula for EBITA Calculation

Calculating EBITA can be approached in two primary ways, depending on the data available in a company’s financial statements. The most direct method starts with Operating Income, which is already a measure of profit before interest and taxes.

Method 1: From Operating Income (EBIT)

EBITA = Operating Income (or EBIT) + Amortization Expense

Alternatively, if you start from the bottom line (Net Income), you must add back all the items that EBITA excludes.

Method 2: From Net Income

EBITA = Net Income + Interest Expense + Tax Expense + Amortization Expense

Both formulas will yield the same result and provide a clear picture of a company’s earnings generated purely from its operations.

Why Amortization is Excluded from EBITA

Amortization is specifically added back to operating income because it is a non-cash expense related to intangible assets. These assets, such as patents, copyrights, trademarks, and goodwill from acquisitions, have a finite useful life over which their cost is spread.

By neutralizing the effect of amortization, EBITA provides a clearer view of a company’s cash-generating ability from its ongoing operations. This adjustment is particularly critical when comparing companies in sectors with high levels of merger and acquisition (M&A) activity, like technology or pharmaceuticals.

A company that grows through acquisitions will have significant goodwill and other intangibles on its balance sheet, leading to high amortization charges that can depress its reported operating income. EBITA allows an analyst to look past these historical acquisition costs and compare the core operational performance of different companies on a more level playing field.

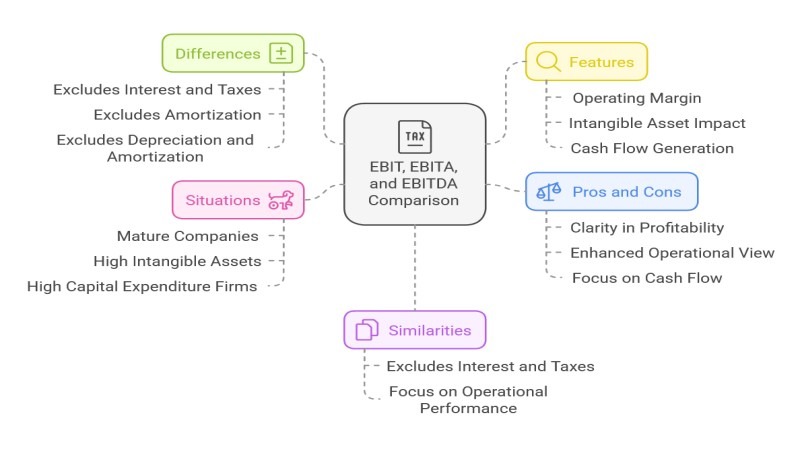

EBITA vs. EBITDA: What’s the Critical Difference for Traders?

The single most critical difference between EBITA and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the treatment of depreciation. EBITDA excludes depreciation, while EBITA includes it (by not adding it back). Depreciation is an accounting method used to allocate the cost of a tangible asset (like machinery, buildings, or vehicles) over its useful life.

Because it represents the very real cost of wear and tear on physical assets essential to a company’s operations, many analysts view EBITA as a more conservative and realistic measure of profitability. By ignoring depreciation, EBITDA can potentially inflate a company’s performance, especially in capital-intensive industries.

When to Use EBITA Over EBITDA

EBITA is the preferred metric when analysing companies in asset-heavy industries where depreciation is a significant and recurring cost of doing business. In these sectors, physical assets are the lifeblood of the operation, and ignoring the cost of their degradation provides an incomplete financial picture. Key examples include:

- Manufacturing: Factories and machinery constantly depreciate and require eventual replacement.

- Transportation & Logistics: Airlines’ fleets, shipping companies’ vessels, and haulage firms’ lorries are all substantial, depreciating assets.

- Utilities & Energy: Power plants, transmission grids, and pipelines have long lifespans but incur massive depreciation expenses.

In these cases, EBITDA can be misleadingly optimistic. A company might show strong EBITDA but could be failing to invest in replacing its ageing assets, a problem that EBITA, by factoring in depreciation, helps to highlight.

Comparative Analysis Table: EBITA vs. EBITDA

| Feature | EBITA | EBITDA |

| Full Name | Earnings Before Interest, Taxes, and Amortization | Earnings Before Interest, Taxes, Depreciation, and Amortization |

| Key Exclusions | Interest, Taxes, Amortization | Interest, Taxes, Amortization, Depreciation |

| Treatment of Assets | Accounts for the cost of tangible assets (depreciation) but not intangible assets (amortization). | Ignores the cost of both tangible and intangible assets. |

| Best For | Asset-heavy industries (manufacturing, utilities, transport) where depreciation is a real operational cost. | Service-based or low-asset industries (software, consulting) or for comparing firms with different asset ages. |

| Conservatism | More conservative. Provides a more grounded view of profitability by including depreciation. | More aggressive. Can inflate the appearance of profitability and cash flow. |

How to Apply EBITA in Your Trading Strategy

Incorporating EBITA into your trading strategy can significantly enhance your ability to assess a company’s core operational efficiency and its capacity to generate cash. A consistently growing EBITA figure over several quarters or years indicates strong operational management and a healthy underlying business, which is often a strong bullish signal.

Traders should analyse the EBITA trend, not just a single period’s number. This analysis, combined with technical charting on a reliable platform such as Ultima Markets MT5, can create a powerful synergy between fundamental strength and market timing.

Using the EV/EBITA Ratio for Company Valuation

The Enterprise Value to EBITA (EV/EBITA) multiple is a potent valuation tool that is often superior to the more common Price-to-Earnings (P/E) ratio. Enterprise Value (calculated as Market Capitalization + Total Debt – Cash & Cash Equivalents) provides a more comprehensive valuation of a company than market cap alone.

Because both EV and EBITA are independent of capital structure (debt levels) and tax rates, the EV/EBITA ratio allows for a more accurate comparison between companies with different financial leverage and tax situations. A company with a lower EV/EBITA ratio compared to its industry peers may be undervalued.

For instance, if a manufacturing firm has an EV/EBITA of 7x while the industry average is 11x, it signals a potential buying opportunity that warrants deeper investigation.

Real Data Example: Analysing Two Manufacturing Companies

A practical example illustrates the analytical power of the EBITA metric. Consider two fictional manufacturing companies in the same sector with identical revenues:

- Company A: Revenue = $100M, Operating Income (EBIT) = $15M, Depreciation = $4M, Amortization = $2M.

- Company B: Revenue = $100M, Operating Income (EBIT) = $16M, Depreciation = $8M, Amortization = $1M.

EBITA Calculation:

- Company A EBITA = $15M (Operating Income) + $2M (Amortization) = $17M

- Company B EBITA = $16M (Operating Income) + $1M (Amortization) = $17M

At first glance, their EBITA figures are identical, suggesting similar operational profitability. However, the crucial insight comes from the components. Company B has double the depreciation charge ($8M vs $4M). A savvy trader must ask why. Does Company B have older, less efficient equipment that is more costly to maintain and depreciates faster?

Or did it recently invest in new, state-of-the-art machinery? EBITA doesn’t give the final answer, but it prompts the critical questions that lead to superior investment decisions. This is where reviewing company reports and management discussions becomes essential.

Limitations and Potential Pitfalls of Using EBITA

While EBITA is a highly useful metric, it is not infallible and can be misleading if used in isolation. As a non-GAAP (Generally Accepted Accounting Principles) metric, its calculation can sometimes vary between companies, so it’s vital to ensure you’re comparing like with like. Its primary limitations include:

- Ignores Capital Expenditures (CapEx): EBITA does not account for the cash spent on purchasing or maintaining fixed assets, which is a critical outlay for any industrial company’s survival and growth.

- Overlooks Changes in Working Capital: Fluctuations in inventory, accounts receivable, and accounts payable can significantly impact a company’s cash position, none of which is reflected in EBITA.

- Doesn’t Reflect Debt Repayments: A company can have a healthy EBITA but still face a liquidity crisis if it has large debt principal repayments due.

Therefore, traders must always use EBITA in conjunction with other financial statements, especially the Statement of Cash Flows. Cross-referencing EBITA with Free Cash Flow (FCF) provides a much more robust and complete picture of a company’s financial health. When you decide to invest, it is also paramount to use a broker with a solid reputation. You can check Ultima Markets Reviews to see how they are rated by other users, ensuring confidence in your trading partner.

Conclusion

For traders and investors committed to making data-driven decisions, EBITA is an indispensable analytical tool. It cuts through significant accounting distortions to offer a clearer, more conservative perspective on a company’s operational profitability than Net Income or even EBITDA, proving particularly insightful in asset-intensive sectors.

By integrating EBITA and the EV/EBITA valuation multiple into your analytical process, you can more effectively identify fundamentally strong companies and uncover potential valuation discrepancies that the broader market may have missed. A practical next step is to choose a company in your portfolio, calculate its EBITA for the last three years, and compare its trend against its primary competitors.

This exercise will help re-evaluate its financial standing and reinforce the robustness of your investment thesis. Correctly utilising EBITA is a hallmark of a sophisticated and discerning financial analyst.

FAQ

Q: What is a good EBITA margin?

A “good” EBITA margin is highly industry-dependent. It is calculated as (EBITA / Total Revenue). For example, a high-growth software company might achieve an EBITA margin of over 30%, whereas a supermarket chain, which operates on high volume and thin margins, might be considered healthy with a 5-8% margin.

The key is not to look for a universal number but to compare a company’s EBITA margin against its direct competitors and its own historical performance to identify trends.

Q: Is EBITA the same as operating income?

No, they are not the same, but they are closely related. EBITA is calculated by taking Operating Income (which is the same as EBIT) and adding the amortization expense back to it. Therefore, EBITA will always be equal to or higher than operating income. The difference between the two figures represents the non-cash charge for that period’s use of intangible assets.

Q: Can EBITA be negative?

Yes, EBITA can certainly be negative. A negative EBITA figure indicates that a company’s core operations are unprofitable, even before accounting for the costs of financing (interest) and taxes. This is a significant red flag for any trader or investor, as it suggests the fundamental business model is not generating a profit from its primary activities.

Q: Why is EBITA not a GAAP metric?

EBITA is considered a non-GAAP (Generally Accepted Accounting Principles) or non-IFRS (International Financial Reporting Standards) metric because it is not a standardized measure defined by official accounting boards. Companies use it to provide additional insight into their performance, but because its calculation is not strictly regulated, it can be susceptible to manipulation. Investors should always check how a company defines and calculates EBITA in its financial reports.

Q: How does EBITA relate to free cash flow?

EBITA can be seen as a very rough, high-level proxy for pre-tax, pre-interest cash flow from operations, but it is not the same as Free Cash Flow (FCF). FCF is a more precise measure of the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

To get from EBITA to FCF, you would need to subtract cash taxes, and then subtract capital expenditures and adjust for changes in working capital. FCF is a much better indicator of a company’s ability to pay down debt, pay dividends, and reinvest in the business.