The British Pound has been showing a strong sign of resilient in 2025, with the GBPUSD surging more than 12% to three years in 2025 before a pullback in November. Hawkish Bank of England Policy, a favorable yield differential versus the US Dollar and Japanese Yen, has been the major drivers behind the momentum.

While the Pound face some pressure in recent as market step into the end of 2025, the Pound is still expected to gain as one of the well performing major currency in 2025.

Policy Divergence as the Core Driver

The Bank of England remains among the most hawkish major central banks in the G10 space. At its October 2025 meeting, the BoE opted to hold rates but delivered a noticeably softer tone. However, the underlying message was clear: the bar for aggressive easing remains high. This stance keeps the UK’s rate differential firmly in favor of the Pound.

In contrast, the Federal Reserve has already entered a renewed easing cycle with back-to-back rate cuts in September and October, and markets are pricing further cuts in the months ahead. The widening policy gap between a gradually dovish Fed and a cautiously restrictive BoE supports continued GBP strength against the Dollar.

Meanwhile, the Bank of Japan remains reluctant to advance its normalization path despite signaling hawkish intentions. With Japanese yields still anchored near the bottom of the G10 spectrum, GBP/JPY continues to benefit from one of the most extreme rate spreads in the FX landscape — a structural tailwind that does not appear likely to reverse soon.

Inflation Keeps BoE on Guard

One of the major reasons for BoE opted to hold is the Underlying domestic inflation continues to complicate the BoE’s path toward easing.

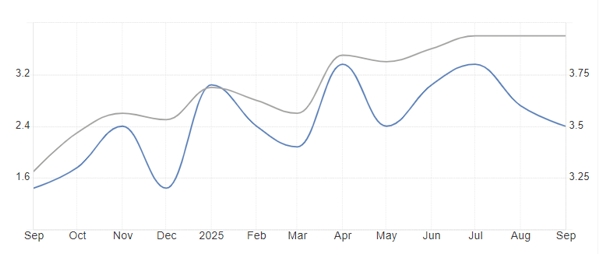

The September CPI reading held at 3.8% year-over-year, while core CPI, although slightly lower, remains significantly above the 2–3% target range. This slow-moving disinflation means any future rate cuts are likely to be gradual, measured, and contingent on further evidence of price stabilization.

UK Headline & Core CPI YoY, Source: Office for National Statistic

The BoE’s forward guidance underscores this conditional approach: policymakers have reiterated that rates may move lower if disinflation progresses, but they have avoided committing to any timeline or pace. In contrast to the Fed’s active cutting cycle, the BoE still has the luxury of time — and this policy restraint is a key factor preserving GBP’s yield appeal.

Macro Implications & Forward View

As long as inflation remains sticky and the BoE maintains caution, the Pound retains cyclical advantage over lower-yielding alternatives. A softer U.S. Dollar driven by Fed easing and a stagnant Japanese Yen anchored by BoJ inertia makes GBP a preferred long opportunity in both GBP/USD and GBP/JPY crosses.

The primary risk to this view lies in broader risk sentiment — a sharp deterioration in global conditions or a shift in BoE policy expectations could trigger a corrective phase. However, in the absence of a major risk-off event or a sudden dovish pivot, the structural case for Pound strength remains intact.

The overarching narrative has not changed: GBP continues to behave like a fundamentally supported currency with asymmetric upside potential, underpinned by rate differentials and policy divergence that are unlikely to meaningfully narrow in the near term.

GBP Outlook — What Comes Next?

Looking ahead, the Pound remains fundamentally supported unless there is a sharp collapse in UK inflation or a meaningful dovish pivot from the Bank of England. As long as inflation remains sticky and the BoE continues to resist aggressive easing, the rate differential should continue to work in favor of GBP appreciation into early 2026.

- This outlook becomes even more constructive if the U.S. Dollar comes under renewed pressure — particularly if the Federal Reserve signals additional easing at the December meeting or beyond.

- At the same time, the Bank of Japan’s reluctance to advance its tightening cycle helps maintain one of the most favorable interest rate spreads in the G10 space, reinforcing GBP strength against both USD and JPY.

Taken together, the broader macro setup reinforces a medium-term bullish bias for the Pound.

Technical Outlook: GBPUSD

GBPUSD, Daily Chart

Following its multi-month advance, GBP/USD broke below the 1.3200 support zone in a broad corrective move. However, the decline has so far lacked follow-through, suggesting underlying resilience despite recent Dollar strength. The price remains broadly supported, and the loss of downside momentum indicates that the pair is consolidating rather than transitioning into a bearish reversal.

If U.S. Dollar weakness resumes — particularly on the back of shifting Fed expectations — the current structure favors a renewed upside move in GBP/USD.

Professional Insights: Awaits Bulls to Regain

Bias: Cautious Bullish (Awaits Regain Support)

Entry Zone: 1.3200 (Regain Above Support)

Target: 1.3600

Technical Outlook: GBPJPY

Compared with the U.S. Dollar, the Pound may offer even stronger upside potential against the Yen due to Japan’s persistent policy stagnation and yield disadvantage.

GBPJPY, H4 Chart

On the charts, GBP/JPY remains structurally bullish despite the recent consolidation phase. The pair is holding above the key 200.00 support zone, which continues to act as a pivotal line in maintaining the broader uptrend. As long as this level holds, the bullish bias remains intact.

A decisive breakout above 205.00 would signal the next leg higher, potentially triggering another impulsive upside wave as rate differentials and carry flows continue to favor the Pound over the Yen.

Professional Insights: Bulls on the Run

Bias: Bullish Momentum

Entry Zone: 200.0 – 201.00 (Buy the dip), 204.50 (Bullish Breakout)

Support: 200.00

Target: 208.00 (The 2024’s Highs)

Risk Outlook – What Could Go Wrong for GBP?

While the macro and policy backdrop continues to favor GBP appreciation, the outlook is not without vulnerabilities. The clearest risk to the bullish Pound narrative lies in a sharp downside surprise in UK inflation. If price pressures fade more rapidly than expected, the Bank of England may be forced into a more aggressive easing cycle — particularly if growth momentum weakens at the same time. Such a shift would narrow the very rate differential currently driving GBP strength and could trigger a broader repricing lower.

The second major risk is domestic growth weakness. The UK economy is already losing momentum beneath the surface, and if slowing demand coincides with rapidly declining inflation, the BoE may have no choice but to cut more aggressively. That scenario would undermine the Pound’s yield premium and reverse current gains.

Externally, a severe risk-off episode — driven by geopolitical shocks or major equity corrections — could also weigh on GBP, especially against haven currencies.

In summary, the Pound’s upside still dominates, but it is conditional: if inflation falls too quickly or growth deteriorates further, the BoE’s hand may be forced — and the Pound becomes vulnerable.