Are you faced with an investment opportunity but unsure if it will truly create value? Deciding whether to invest in a new project, piece of equipment, or financial asset can be daunting. Many rely on simple profit metrics, but these often ignore a crucial factor: the time value of money. The principle that a dollar today is worth more than a dollar tomorrow is the bedrock of modern finance. This is where understanding Net Present Value (NPV) becomes a game-changer. This comprehensive guide will walk you through everything you need to know, from the core formula to practical calculations, enabling you to analyse opportunities with confidence and make sound financial decisions that drive real growth.

What is Net Present Value (NPV)? A Clear Definition

Before diving into complex calculations, it is essential to grasp the core concepts that underpin the Net Present Value method. At its heart, NPV is a capital budgeting technique used to evaluate the profitability of a project or investment. It calculates the difference between the present value of future cash inflows and the present value of cash outflows over a period.

The Fundamental Principle: The Time Value of Money

The time value of money (TVM) is the foundational idea that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity. This core principle is based on two key factors:

- Opportunity Cost: Money received today can be invested to earn a return. If you receive the money later, you miss out on this potential interest or profit.

- Inflation: The purchasing power of money tends to decrease over time due to inflation. A dollar today can buy more goods and services than a dollar in five years.

NPV analysis directly incorporates this principle by ‘discounting’ all future cash flows back to their present-day value, allowing for a fair comparison.

Defining Net Present Value (NPV): The True Value of an Investment

In simple terms, the Net Present Value is the sum of all discounted future cash flows (both positive and negative) generated by an investment, minus the initial capital outlay. The result is a single, absolute monetary figure that represents the total value an investment is expected to add to the company or investor. It directly answers the question: ‘After accounting for the initial cost and the time value of money, how much is this investment really worth to us today?’

Why NPV is a Superior Metric to Simple Profitability

Many businesses use simpler metrics like the Payback Period (how long it takes to recoup the initial investment) or Accounting Profit. While easy to calculate, these methods are flawed because they ignore the timing and risk of cash flows. A project that returns $10,000 in Year 1 is fundamentally more valuable than one that returns $10,000 in Year 5. NPV is superior because it provides a more realistic and comprehensive financial picture by focusing on cash flow, not just profit, and explicitly accounting for the time value of money.

The Net Present Value Formula and Its Core Components

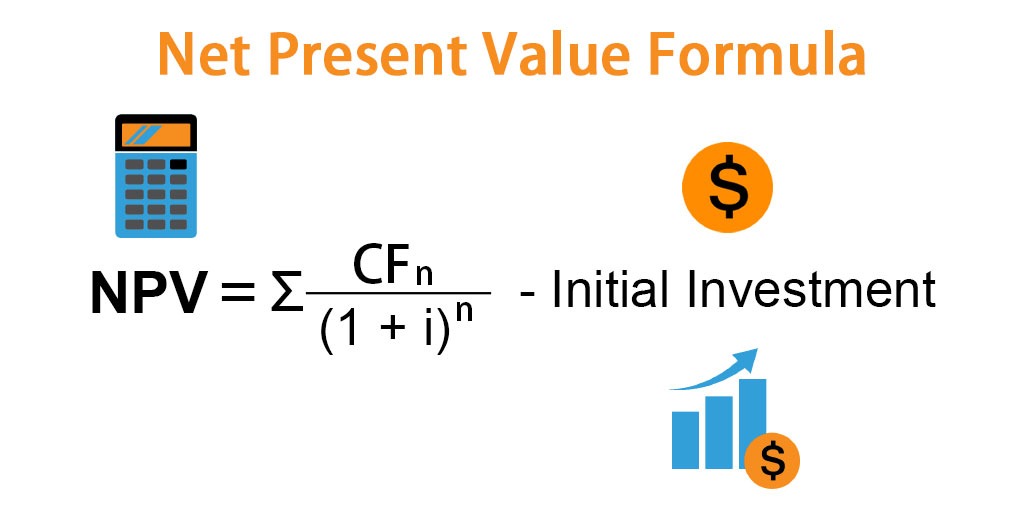

The formula for NPV can appear intimidating at first, but it is straightforward once you understand its individual parts.

The Formula Explained: NPV = Σ [Rt / (1+i)^t] – Initial Investment

Where:

- Rt = Net cash flow during a single period t (cash inflow minus cash outflow)

- i = Discount rate or the required rate of return per period

- t = The number of time periods (e.g., year, quarter)

- Σ = The summation symbol, meaning you add up the values for each period.

Key Elements Breakdown

Understanding each component of the Net Present Value formula is crucial for an accurate calculation.

- Initial Investment (C0): This is the total cost of the project at the beginning (at time t=0). It’s always a negative cash flow because it’s money going out. This includes the purchase price of an asset plus any other initial costs like installation or training.

- Future Cash Flows (Rt): These are the projected net cash flows (inflows minus outflows) that the investment is expected to generate for each period. Forecasting these accurately is one of the most challenging aspects of NPV analysis.

- Discount Rate (i): This is arguably the most critical input. The discount rate represents the minimum rate of return an investor expects to earn on an investment of comparable risk. It is also often referred to as the ‘hurdle rate’ or the company’s Weighted Average Cost of Capital (WACC). A higher discount rate implies greater risk and will result in a lower NPV, and vice versa.

- Time Period (t): This represents the lifespan of the investment or project, typically measured in years. Each period’s cash flow is discounted according to how far in the future it occurs.

How to Calculate Net Present Value: A Step-by-Step Guide

Calculating NPV is a methodical process. Following these steps ensures you account for all necessary variables correctly.

Step 1: Identify the Initial Investment

Determine the full cost of the investment that occurs at the start (Year 0). This is your initial cash outflow.

Step 2: Forecast the Net Cash Flows for Each Period

Estimate the net cash flows (revenues minus expenses) for each period over the project’s life. Be realistic and base these forecasts on solid data and market analysis.

Step 3: Determine the Appropriate Discount Rate

Select a discount rate that reflects the riskiness of the investment and the company’s cost of capital. This rate must be consistent with the period of the cash flows (e.g., an annual rate for annual cash flows).

Step 4: Calculate the Present Value of Each Cash Flow

For each time period ‘t’, use the formula PV = Rt / (1+i)^t to discount the future cash flow back to its present value.

Step 5: Sum the Present Values and Subtract the Initial Investment

Add up all the present values calculated in Step 4. Then, subtract the initial investment from Step 1. The result is the Net Present Value.

The NPV Rule: Interpreting the Results for Decision-Making

Once you have calculated the NPV, the decision rule is simple and unambiguous.

Positive NPV (> $0): A Green Light for Investment

A positive Net Present Value indicates that the projected earnings from the investment, discounted to today’s value, exceed the anticipated costs. The project is expected to generate a return greater than the discount rate and will therefore create value for the firm. The project should be accepted.

Negative NPV (< $0): A Clear Signal to Reject

A negative NPV shows that the project’s costs outweigh its discounted future earnings. The investment is expected to earn less than the required rate of return, resulting in a net loss of value. The project should be rejected.

Zero NPV (= $0): The Point of Indifference

A zero NPV means the project is expected to generate returns exactly equal to the discount rate. It doesn’t destroy value, but it doesn’t create any extra value either. From a purely financial standpoint, the company would be indifferent between accepting the project and not.

Practical Example: Calculating the NPV for a Business Project

Let’s consider a company planning to buy a new machine for $50,000. It’s expected to generate an additional $15,000 in net cash flow each year for the next 5 years. The company’s required rate of return (discount rate) is 10%.

Scenario Breakdown & Data Table

| Year | Cash Flow | Present Value Formula | Present Value at 10% |

| 0 | -$50,000 | -$50,000 | -$50,000.00 |

| 1 | +$15,000 | $15,000 / (1.10)^1 | $13,636.36 |

| 2 | +$15,000 | $15,000 / (1.10)^2 | $12,396.69 |

| 3 | +$15,000 | $15,000 / (1.10)^3 | $11,269.72 |

| 4 | +$15,000 | $15,000 / (1.10)^4 | $10,245.20 |

| 5 | +$15,000 | $15,000 / (1.10)^5 | $9,313.82 |

| Net Present Value (Sum of PVs – Initial Investment) | $6,861.79 | ||

Final Calculation and Interpretation

The sum of the present values of all future cash flows is $56,861.79.

NPV = $56,861.79 – $50,000 = $6,861.79.

Since the Net Present Value is positive, the investment is financially viable and should be accepted. It is expected to generate a value of $6,861.79 in today’s money, over and above the required 10% return.

Advantages and Disadvantages of Using Net Present Value Analysis

The Key Benefits of the NPV Method

- Consider the Time Value of Money: This is its greatest strength. It provides a realistic valuation by acknowledging that future cash is worth less than present cash.

- Provide an Absolute Value: NPV gives a clear, absolute dollar figure representing the value added. This is intuitive and easy to communicate to stakeholders. A project with a $10 million NPV is clearly better than one with a $2 million NPV.

- Focus on Cash Flows: It uses cash flows rather than accounting profits, which can be manipulated by depreciation and other non-cash expenses. Cash flow is a more accurate measure of a project’s financial performance.

Potential Drawbacks and Limitations

- Sensitivity to the Discount Rate: The calculation is highly sensitive to the chosen discount rate. A small change in this rate can significantly alter the NPV and potentially change the investment decision from accept to reject.

- Reliance on Forecasts: NPV depends heavily on forecasts of future cash flows, which are inherently uncertain and can be inaccurate. The principle of ‘Garbage In, Garbage Out’ (GIGO) applies strongly here.

- Doesn’t Account for Project Size: A $1,000 NPV on a $1 million project is very different from a $1,000 NPV on a $5,000 project. NPV alone doesn’t show the efficiency of the capital used. For this, a complementary metric like the Profitability Index (PI) can be useful.

How NPV Principles Apply to Financial Market Trading

While Net Present Value is traditionally a capital budgeting tool for corporations, its core principle—valuing future income streams in today’s terms—is fundamental to long-term investing and trading. This concept is the basis of Discounted Cash Flow (DCF) valuation, a cornerstone of fundamental analysis for stocks and other assets.

For traders using advanced platforms like Ultima Markets MT5, applying this concept helps in evaluating an asset’s intrinsic value. When you analyse a company’s stock, you are essentially estimating its future earnings or dividends (the cash flows) and discounting them back to the present to determine if its current market price is justified. If your calculated present value is higher than the current market price, the stock may be undervalued and represent a good buying opportunity.

This mindset helps differentiate between short-term speculation and long-term value investing. It encourages traders to think like business owners, focusing on the underlying value and long-term potential of an asset. When engaging in such strategies, choosing a reliable broker is paramount.

Reading Ultima Markets Reviews can provide insight, and understanding the broker’s commitment to fund safety is crucial for protecting your capital. The entire process, from research to execution and managing funds via straightforward deposits & withdrawals, is part of a disciplined, value-oriented trading approach inspired by NPV principles.

Conclusion: Making Financially Sound Decisions with NPV

Mastering the Net Present Value (NPV) calculation is an essential skill for anyone involved in finance, business, or serious investing. It moves beyond simple gut feelings and provides a robust, data-driven framework for evaluating opportunities. By properly discounting future cash flows, you can gain a clear picture of a project’s potential to create real, measurable value.

While it has its limitations and relies on assumptions, NPV remains the gold standard for investment appraisal. Used wisely, it is a powerful tool in your financial arsenal, guiding you towards more profitable and strategically sound decisions with platforms like Ultima Markets.

FAQ

Q:What is considered a ‘good’ Net Present Value?

In simple terms, any positive NPV is considered ‘good’ because it indicates the project is expected to generate more value than it costs, after accounting for the required rate of return. However, the ‘goodness’ is relative. When comparing multiple mutually exclusive projects, the one with the higher positive NPV is generally the better choice, as it promises to add the most value.

Q:Why is the discount rate so important in the NPV formula?

The discount rate is crucial because it represents the risk and opportunity cost of the investment. It is the ‘hurdle’ that the project’s returns must clear. A higher discount rate significantly reduces the present value of future cash flows, reflecting higher perceived risk. Choosing an inappropriate rate can lead to poor decisions: too low, and a bad project might look good; too high, and a profitable project might be unfairly rejected.

Q:What is the main difference between Present Value (PV) and Net Present Value (NPV)?

Present Value (PV) is the value today of a ‘single’ future cash flow or a series of them. Net Present Value (NPV) takes it a step further: it is the sum of all the present values of future cash flows *minus* the initial investment cost. In essence, PV is a component of the NPV calculation. NPV provides a complete picture of profitability by netting the initial cost against the discounted future benefits.

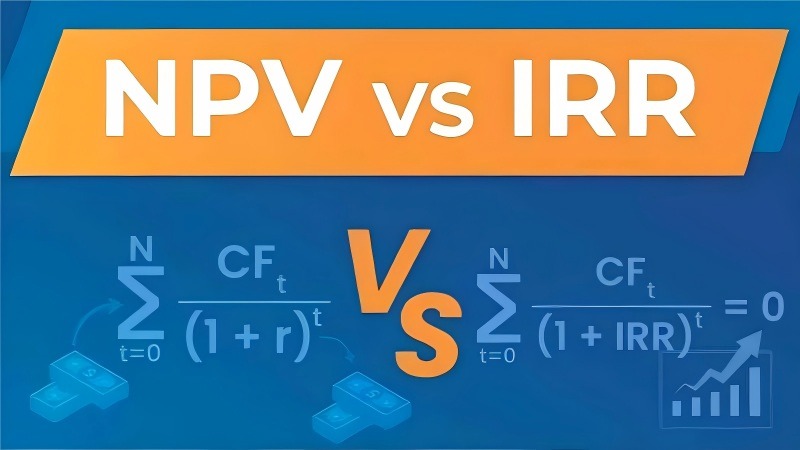

Q:How does NPV compare to the Internal Rate of Return (IRR)?

NPV provides an absolute dollar value of the project’s worth, while IRR provides a percentage rate of return. While IRR is popular, NPV is generally considered theoretically superior. This is because IRR can sometimes give misleading results for projects with unconventional cash flows (e.g., multiple sign changes) or when comparing mutually exclusive projects of different scales. NPV always leads to the correct decision in these cases by focusing on maximizing absolute value.