The appeal of keeping more of your hard-earned salary drives many to rethink financial planning. While federal income tax applies nationwide, several states have eliminated state-level income tax entirely. This guide explores the nine states with no income tax, the trade-offs behind the policy, and how these differences affect your overall financial outlook.

Which States Have No Income Tax? The Complete List

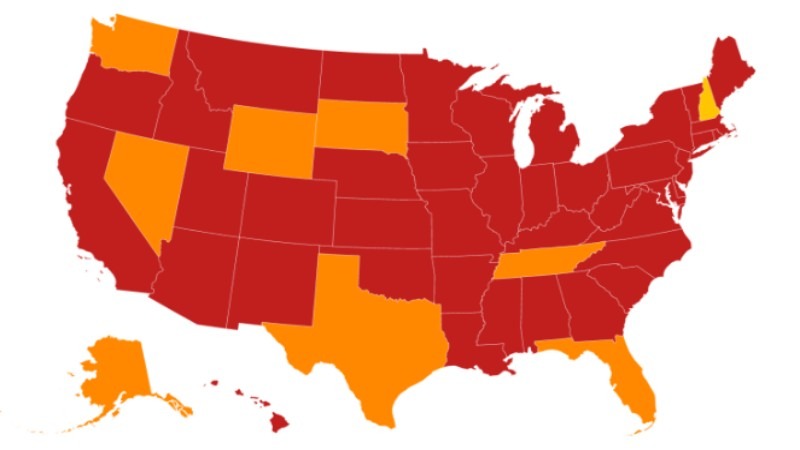

As of 2025, nine states impose no broad-based personal income tax. They attract high earners and retirees alike, though one—New Hampshire—still has a limited tax exception.

The 9 States With Zero or Limited Income Tax

| State | Key Economic Driver(s) | Noteworthy Tax Fact |

| Alaska | Oil & Gas | Pays residents an annual dividend (Permanent Fund Dividend). |

| Florida | Tourism, Healthcare, Real Estate | Relies heavily on sales tax from its large tourism industry. |

| Nevada | Tourism, Gaming, Mining | High sales tax rates, particularly in tourist areas. |

| New Hampshire | Manufacturing, Healthcare, Tech | No tax on wages, but currently taxes interest and dividend income (phasing out). |

| South Dakota | Agriculture, Finance, Healthcare | Business-friendly, a hub for credit card companies. |

| Tennessee | Music, Automotive, Healthcare | One of the highest combined state and local sales tax rates in the US. |

| Texas | Oil & Gas, Technology, Corporate HQs | No income tax, but often has high property tax rates. |

| Washington | Technology, Aerospace, Retail | High state sales tax; recently introduced a capital gains tax for high earners. |

| Wyoming | Mining (Coal, Natural Gas), Tourism | Lowest population state, relies heavily on mineral severance taxes. |

A Special Note on New Hampshire and Washington

It is important to clarify the exceptions. While New Hampshire does not tax wages, it has historically taxed income from interest and dividends. This is known as the Interest and Dividends (I&D) Tax.

However, the state is in the process of phasing out this tax completely, with full repeal expected soon. Similarly, while Washington has no general income tax, it recently implemented a 7% tax on capital gains exceeding $250,000 annually, which primarily affects very high-income investors.

How Do States Without Income Tax Generate Revenue?

No-income-tax states still rely on other taxes to fund public services. Understanding this “tax swap” helps assess whether relocating truly benefits you financially.

Higher Property Taxes

States like Texas and New Hampshire offset the lack of income tax with high property taxes, often among the nation’s highest. Research local rates before moving, as they vary widely and can offset much of your savings.

Sales and Excise Taxes

Tourism-heavy states such as Florida and Nevada rely on sales tax, effectively passing some tax burden to visitors. Tennessee’s combined state and local sales taxes often approach 10%, among the nation’s highest. Excise taxes on fuel, alcohol, and tobacco are also common revenue sources.

Other Revenue Streams

These states are often creative in how they fund their budgets. Natural resource-rich states like Alaska and Wyoming impose severance taxes on the extraction of minerals, oil, and gas. Nevada collects significant revenue from gaming taxes. Others may rely more heavily on corporate taxes, franchise taxes (like Texas’s Margin Tax), and various fees for state services. This diversification is key to their fiscal stability.

The Pros and Cons of Living in States With No Income Tax

The decision to relocate to one of the states with no income tax involves a careful weighing of the advantages and disadvantages. What works for a high-income remote worker might not be suitable for a low-income family or a retiree on a tight budget. Making such a significant financial move requires thorough due diligence, and reading reviews of financial services can help you prepare.

| Advantages (Pros) | Disadvantages (Cons) |

| •Increased Take-Home Pay: The most direct benefit is a larger net salary, providing more disposable income for saving, investing, or spending. •Attraction for High Earners: High-income individuals and business owners can save tens of thousands of dollars annually. •Retirement-Friendly: Tax savings on retirement income (pensions, Social Security, 401(k) withdrawals) can significantly extend the life of a nest egg. •Potential for Economic Growth: A favourable tax climate can attract businesses, leading to job creation and economic dynamism. | •Higher Cost of Living in Other Areas: The ‘tax trade-off’ often means higher property and sales taxes that can diminish savings. •Regressive Tax System: Sales and property taxes can disproportionately impact lower-income households, who spend a larger percentage of their income on necessities. •Potential for Underfunded Public Services: In some areas, lower overall tax revenue may lead to less funding for schools, healthcare, and infrastructure. •Not a ‘Tax-Free’ Guarantee: Federal income tax, FICA (Social Security and Medicare), and local taxes still apply. |

A Deeper Dive: State-by-State Analysis

To truly understand the landscape, let’s examine each of the nine states with no income tax more closely.

Alaska

Fueled by oil and gas, Alaska funds itself through severance taxes and its Permanent Fund. Residents even receive an annual dividend, but high living costs and remoteness offset the advantage.

Florida

Florida’s lack of income tax attracts retirees and remote workers. It relies on tourism revenue and a 6% state sales tax. While property tax rates are moderate, high home values and insurance costs can add up.

Nevada

Built on tourism and gaming, Nevada funds itself through high sales taxes and specific taxes on the gaming industry. While property taxes are relatively low, the cost of living in its major metropolitan areas, Las Vegas and Reno, has been rising rapidly. The economy can be less diversified than in other states, making it more susceptible to downturns in the tourism sector.

New Hampshire

With its motto “Live Free or Die,” New Hampshire prides itself on fiscal independence. It has no general sales tax and no tax on earned income. Its primary revenue source is one of the nation’s highest average property tax rates. This makes it a state of stark contrasts: a great place to earn a salary, but a potentially expensive place to own a home.

South Dakota

South Dakota has cultivated a very business-friendly environment, particularly for financial services companies, thanks to its lack of corporate or personal income tax. The state relies on sales and use taxes. Its low population density and agriculture-focused economy contribute to a lower cost of living, but also fewer metropolitan amenities and job opportunities in certain sectors.

Tennessee

A growing hub for music, entertainment, and healthcare, Tennessee attracts new residents with its lack of income tax on wages. However, it has one of the highest total sales tax burdens in the country, with a state rate of 7% plus local taxes that can push the total near 10% in many areas. This means that while you save on your payslip, you pay more on everyday purchases.

Texas

The Lone Star State is an economic powerhouse, attracting major corporations and a flood of new residents. The absence of an income tax is a major draw. The counterbalance is high property taxes, which are set at the local level and can be a significant financial burden for homeowners. The state also levies a complex corporate franchise tax and taxes on oil and gas production.

Washington

Washington, home to major tech firms, imposes no personal income tax but relies on high sales and business taxes. A new capital gains tax for top earners marks a shift in its tax model.

Wyoming

Wyoming offers a low overall tax burden, with no personal or corporate income tax and a low state sales tax. Much of its revenue comes from severance taxes on its vast mineral and energy resources. This makes it fiscally stable but also dependent on fluctuating commodity prices. It is the least populous state, offering a rural lifestyle with abundant outdoor recreation.

Who Benefits Most from States With No Income Tax?

While everyone enjoys a bigger payslip, certain demographics stand to gain the most from relocating to one of these states. Those with substantial savings can manage their funds through reliable platforms, paying close attention to fund safety protocols.

High-Income Earners and Entrepreneurs

For high earners, savings grow with income. Avoiding state tax can save tens of thousands annually—money that can be reinvested through trusted platforms like MT5.

Retirees

Retirees benefit from untaxed 401(k), pension, and Social Security income, extending retirement savings and preserving wealth for heirs.

Remote Workers

The rise of remote work has made it possible for professionals to choose where they live based on lifestyle and financial factors rather than proximity to an office. By establishing legal residency (domicile) in one of the states with no income tax, a remote worker can legally avoid paying state income tax on their salary, even if their employer is based in a high-tax state. However, this requires careful planning to meet residency requirements and navigate complex cross-state tax laws.

Conclusion

Living in states with no income states can be advantageous, but higher property and sales taxes often balance the savings. The best choice depends on your income, lifestyle, and housing plans. Calculate your total tax burden before deciding. Trusted financial platforms like Ultima Markets can help evaluate your options.

FAQ

Q: Is it always cheaper to live in states with no income tax?

Not always. High sales or property taxes in states like Texas or New Hampshire can offset income tax savings. Compare your full cost of living before deciding.

Q: If I live in a no-income-tax state but work for a company in a state with income tax, do I have to pay?

This is a complex area of tax law. The answer often depends on the rules of the state where your employer is based. Some states have a “convenience of the employer” rule, which means if you are working remotely for your own convenience rather than your employer’s necessity, you may still owe income tax to your employer’s state. It is highly advisable to consult with a tax professional who specialises in multi-state taxation.

Q: What is the difference between an income tax and a capital gains tax at the state level?

Income tax typically applies to wages, salaries, and other forms of earned income. Capital gains tax applies to the profit from the sale of assets like stocks, bonds, or real estate. In most states that have an income tax, capital gains are also taxed. The nine states with no income tax also do not have a broad-based state-level capital gains tax, which is a significant benefit for investors (with the noted exception for high earners in Washington).

Q: Can moving to states with no income tax help me save for a down payment on a house?

Absolutely. The additional money in your net pay each month can be substantial. For example, saving an extra $500 per month by avoiding state income tax would result in an additional $6,000 per year. This can be directed towards a savings account specifically for a house down payment or other major financial goals. Efficiently managing these savings requires reliable systems for deposits and withdrawals.